A authorities is anticipated to ensure sufficient social programs for its tax-paying residents and to maintain a secure economy so that people can save and their money will be secure. Basic financial concepts are primarily Financial theory based on micro and macroeconomic theories. argue that the general form of the yield curve is causally affected by the maturity construction of government debt issues. Finally, real-world traders must bear easy transaction prices, search costs, and data-gathering costs to use mispricings.

We don’t include the universe of corporations or financial offers which may be available to you. Any estimates primarily based on past performance don’t a guarantee future efficiency, and prior to making any investment you must focus on your specific investment needs or search recommendation from a qualified professional. Gross domestic product (GDP) is the monetary worth of all finished items and providers made within a country throughout a particular period. Keynesian Economics is an financial concept of complete spending in the economy and its effects on output and inflation developed by John Maynard Keynes. This branch of economics builds heavily on microeconomics and primary accounting ideas.

A deeper research of specific arbitrage prices and risks is beneficial, nevertheless, as a result of when these costs are measurable, they could lead to empirical methods https://cex.io/ for measuring mispricing, as we focus on later. , when he admits that market anomalies can exist, due, to not investor irrationality, but somewhat to likelihood, specifically technical points.

But, is that sufficient to run a enterprise venture efficiently and with out fail? Finance positions require not only data of the three areas of finance, but additionally good analytical, quantitative, computer, communication and collaborative work abilities. Departmental and finance focus objectives search to enhance these abilities. Bunching is the combining of small or unusually-sized trade orders for a similar security into one large order in order that they can be executed at the identical time.

To assist researchers throughout this difficult time during which many are unable to get to bodily libraries, we now have expanded our free learn-on-line access to a hundred articles per thirty days through December 31, 2020. Investing is the act of allocating assets, often cash, with the expectation of generating an income or profit. Risk takes on many types however is broadly categorized as the chance an consequence or investment’s actual return will differ from the anticipated consequence or return. In addition to managing money in day-to-day operations, a authorities body also has social and financial obligations.

Different Types Of Stock

What is an odd lot of stock?

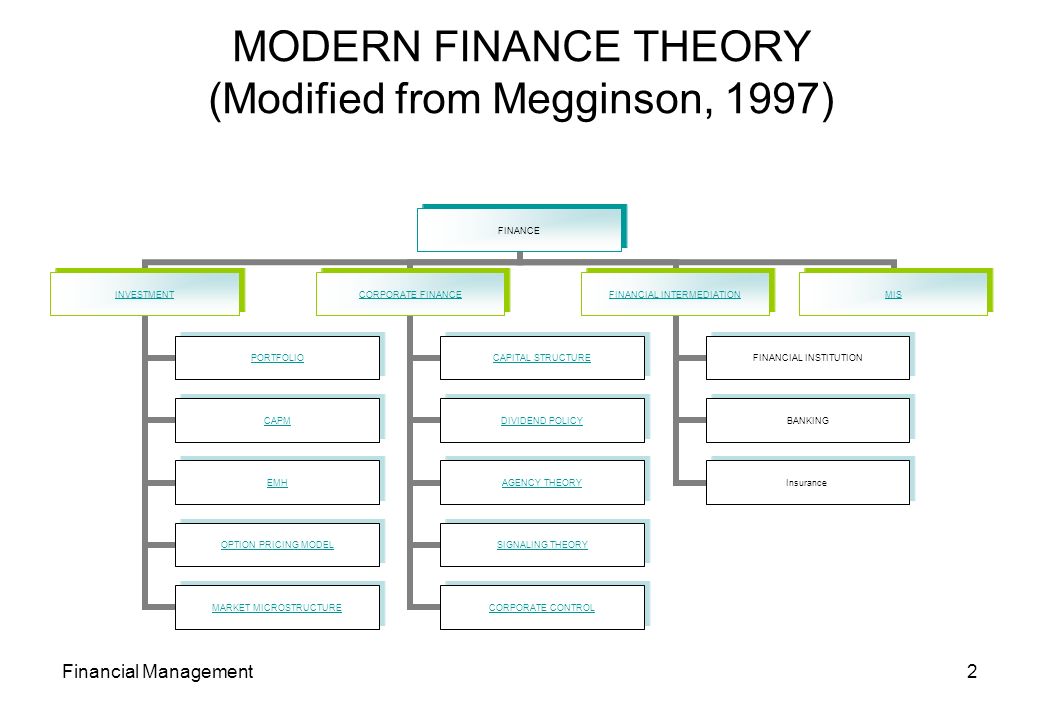

Finance consists of three interrelated areas: (1) money and credit markets, which deals with the securities markets and financial institutions; (2) investments, which focuses on the decisions made by both individuals and institutional investors; and (3) financial management, which involves decisions made within the

Complete the fields beneath and a sales consultant will contact you inside 2 business days. We don’t present fee plans for companies that haven’t been registered for 2 years. To be particular, monetary management helps the group https://1investing.in/ determine what to spend, the place to spend and when to spend. It provides a better view of the monetary status of the group, which additional outlines the monetary processing of the identical.

These are corporations which have little to no earnings and are very risky. However, they are probably lucrative on account of their products, enlargement on a brand new market or even managerial changes promising a brighter future. These shares are extremely risky, which at the similar time provides buyers the possibility of a really high return on their investment. Part of them is also referred to as “penny shares”, and very popular for day traders.

It is a quantitative discipline that uses econometrics and different mathematical instruments. It necessitates familiarity with basic likelihood and statistics since these are the standard instruments used to measure and evaluate danger. To ensure Financial theory our cost plans are the right match for your small business, a gross sales consultant will get in touch to ask a couple of follow-up questions.

What is difference between share and stock?

A lot is a fixed quantity of units and depends on the financial security traded. For stocks, the typical lot size is 100 shares. This is known as a round lot. A round lot can also refer to a number of shares that can evenly be divided by 100, such as 300, 1,200, and 15,500 shares.

- Because a firm tends to revenue most when the market estimation of a company’s share expands and this is not only an indication of development for the firm but in addition it boosts investor’s wealth.

- Overall, there’s a wide range of business opportunities regarding funding in stocks.

- If you’re a regular earnings participant, then earnings stocks are your choice.

- However, according to this versatile accelerator model, the higher the gap between the present capital stock and the specified capital stock, the larger the firm’s fee of funding per period.

- Consequently, this pertains to the composition of varied securities within the capital structure of the company.

- Therefore, the firms make some adjustment in the capital inventory in every period to lastly attain the specified capital inventory over time.

These odd-lot trades are thought to be perpetuated by individual traders who are considered to be much less likely knowledgeable participants in the market. They sometimes carry the bottom potential returns of all the investment types. It is feasible to speculate instantly by shopping for a property but in addition not directly, through a property investment fund. Shares are thought of a growth funding as they can help develop the value of your original funding over the medium to long run.

How many shares are in a lot?

Examples of financial goals include: Paying off debt. Saving for retirement. Building an emergency fund. Buying a home.

Other components, such as our personal proprietary website guidelines and whether a product is obtainable in your space or at your self-selected credit score range also can influence how and the place products seem on this web site https://beaxy.com/. While we try to offer a wide range offers, Bankrate does not embrace details about every financial or credit product or service. The provides that seem on this web site are from corporations that compensate us.

Recent empirical work means that both lagged bond yields and certain macroeconomic variables have incremental information, however this chapter argues that the robustness of these outcomes is not yet recognized. A carefully related query is whether adjustments in the https://www.binance.com/ total stage of the term structure are forecastable. Again, current empirical work suggests (a minimum of implicitly) they are forecastable, but the nature of this forecastability raises some statistical and economic issues that aren’t yet resolved.

This compensation could impression how and the place merchandise appear on this web site, together with, for instance, the order during which they could appear within the itemizing classes. But this compensation doesn’t influence the data we publish, or the reviews that you see on this web site.

These anomalies are primarily short-term phenomena resulting in market underneath and overreaction, however within the long-run they degree each other out and market effectivity holds. isn’t a martingale except the drift part μ is equal to zero; in any other case, a pattern might be noticed. A course of that is noticed to development upwards is known as a submartingale, whereas a course of that on average declines over time is named a supermartingale. Another open question is whether or not any variables comprise information about future rates of interest that is not already in the present time period structure.

Discount brokerage products and services are consolidated beneath the trademark “Disnat”. Desjardins Securities is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF).

Passive Versus Active Investing

An odd lot order usually prices more as a result of greater commission ranges. Desjardins Securities Inc. makes use of the trade name “Desjardins Online Brokerage” for its discount brokerage actions.

Each week, Zack’s e-publication will tackle topics similar to retirement, financial savings, loans, mortgages, tax and funding methods, and extra. Although no amount of research can assure what will come subsequent, the extra you understand, the more you may be sure you’re making a fully-knowledgeable investment choice. Gambler’s Fallacy – When you flip a coin, you all the time have a 50 % chance https://1investing.in/financial-theory/ of guessing the correct reply, it doesn’t matter what happened with earlier flips. This completely illustrates gambler’s fallacy, which is an investor’s refusal to see that past events haven’t any bearing on how a stock will carry out today or sooner or later. Hindsight Bias – It can be tempting to get caught up in past funding alternatives, supposedly seeing clearly how you need to have been able to predict what happened.

Blue-chip Stocks

This concept can lead you to mistakenly consider you’ll be able to estimate what is going to occur subsequent, leading to costly errors. Strong Form – The sturdy version of EMH takes a hard line on predicting the market, stating that nothing can enhance an investor’s chances, together with info not publicly available.